Amidst the ongoing pandemic, individuals and families have been facing various financial challenges. In this article, readers will find valuable tips and advice on finance and budgeting during these uncertain times. From navigating inflation rates to managing debt and finding ways to save money, this article provides practical strategies to help individuals and families weather the financial storm caused by the pandemic. Whether readers are looking for ways to stretch their budget or seeking guidance on financial assistance programs, this article aims to empower readers with useful information to overcome financial obstacles and achieve financial stability in these challenging times.

Budgeting Tips

Evaluate Your Income and Expenses

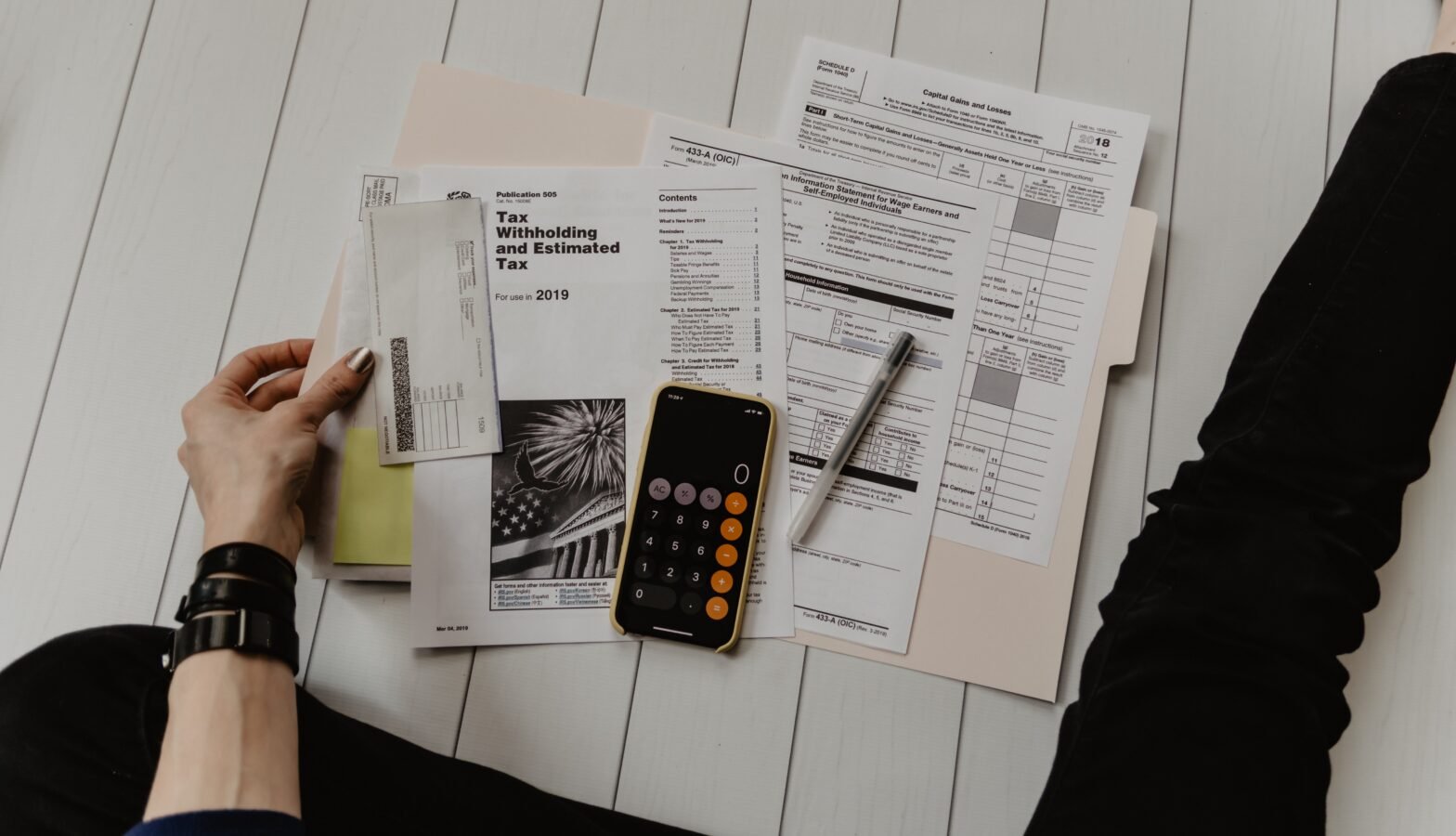

When it comes to creating a budget, the first step is to evaluate your income and expenses. Take a close look at your monthly income, including salary, bonuses, and any other sources of income. This will give you a clear understanding of how much money you have coming in each month.

Next, analyze your expenses. Make a list of all your monthly bills, such as rent or mortgage payments, utilities, transportation costs, groceries, and any other regular expenses. It’s important to be thorough and include even the smallest expenses, as they can add up over time.

Once you have a clear picture of your income and expenses, you can move on to the next step of creating a budget plan.

Create a Budget Plan

Creating a budget plan is crucial for managing your finances effectively. Start by setting financial goals, such as saving for a down payment on a house, paying off debt, or building an emergency fund. These goals will guide your budgeting decisions and help you stay focused on your financial objectives.

Next, allocate your income towards different categories in your budget, such as housing, transportation, food, entertainment, and savings. Be realistic and prioritize your essential expenses first. It’s important to have a clear understanding of how much you can afford to spend in each category.

Consider using budgeting tools such as spreadsheets or mobile apps to help you track your income and expenses and stay organized. These tools can make it easier to monitor your budget and adjust it as needed.

Identify Essential and Non-Essential Expenses

When creating a budget, it’s important to identify which expenses are essential and which are non-essential. Essential expenses are those that are necessary for your basic needs, such as housing, utilities, transportation, and groceries. Non-essential expenses, on the other hand, are those that are not necessary for your survival, such as dining out, entertainment, and shopping for luxury items.

By identifying these categories, you can allocate your income accordingly and ensure that your essential expenses are covered before spending on non-essential items. This will help you prioritize your spending and make informed decisions about where to cut back if needed.

Cut Back on Non-Essential Expenses

Once you have identified your non-essential expenses, it’s time to cut back on them if necessary. Look for areas where you can reduce spending without sacrificing your basic needs. For example, you can try cooking at home instead of dining out, cancel unnecessary subscriptions or memberships, and limit your entertainment expenses.

It’s important to be mindful of your spending habits and make conscious decisions about where you can cut back. This may require making sacrifices and adjusting your lifestyle, but it can have a significant impact on your overall financial health.

Look for Ways to Increase Your Income

In addition to cutting back on expenses, another effective way to improve your financial situation is to look for ways to increase your income. This may involve seeking a raise or promotion at your current job, taking on a side gig or freelance work, or exploring new opportunities for career growth.

Increasing your income can give you more financial flexibility, allowing you to save more, pay off debt faster, or invest in your future. It’s important to be proactive and seek out opportunities to increase your earning potential.

Consider Temporary Savings Strategies

If you’re struggling to make ends meet or facing a temporary financial setback, there are several savings strategies you can consider to help you through this challenging time. One option is to implement a “spending freeze” for a specific period of time, where you avoid unnecessary expenses and focus on essentials only.

Another strategy is to participate in a “no-spend challenge,” where you commit to not spending money on non-essential items for a certain period, such as a week or a month. This can help you save money quickly and reset your spending habits.

Additionally, you can explore ways to reduce your fixed expenses temporarily, such as negotiating lower bills or switching to a more affordable service provider.

Track Your Expenses Regularly

Once you have created a budget, it’s important to track your expenses regularly to ensure that you are staying on track and not overspending. This can be done manually by recording your expenses in a spreadsheet or notebook, or by using budgeting apps that automatically track your transactions.

When tracking your expenses, be diligent and record every purchase, no matter how small. This will give you a clear picture of where your money is going and help you identify areas of improvement.

Regularly reviewing your expenses will also allow you to make adjustments to your budget as needed. If you notice that you are consistently overspending in certain categories, you can make the necessary changes to ensure that you stay within your budget.

Adjust Your Budget as Needed

Budgeting is not a one-time task; it requires ongoing monitoring and adjustments. As your financial situation changes, such as getting a raise, paying off debt, or facing unexpected expenses, it’s important to adjust your budget accordingly.

Regularly review your income and expenses to ensure that your budget reflects your current financial situation and goals. If you have achieved a certain financial milestone, such as paying off a debt, consider reallocating the money you were putting towards that debt towards other financial goals, such as saving for retirement or building an emergency fund.

It’s important to be flexible and adaptable with your budgeting approach to ensure that it continues to meet your needs and align with your financial objectives.

Explore Budgeting Apps and Tools

In today’s digital age, there are countless budgeting apps and tools available that can help you manage your finances more effectively. These apps can automate many aspects of budgeting, such as tracking income and expenses, categorizing transactions, and creating visual representations of your spending habits.

Explore different budgeting apps and tools to find one that suits your needs and preferences. Some popular options include Mint, YNAB (You Need a Budget), and Personal Capital. These apps often provide additional features and resources, such as goal setting, bill reminders, and personalized financial insights.

Using budgeting apps and tools can streamline your budgeting process and make it easier to stay on top of your finances.

Seek Professional Financial Advice

If you find yourself struggling with budgeting or facing complex financial situations, it may be beneficial to seek professional financial advice. A financial advisor can provide personalized guidance and expertise to help you make informed financial decisions and achieve your goals.

A financial advisor can help you create a comprehensive financial plan, identify areas for improvement in your budget, and guide you through various financial challenges, such as debt management, investment strategies, or retirement planning.

When choosing a financial advisor, consider their qualifications and experience, as well as their approach to financial planning. It’s important to find someone who understands your unique financial situation and goals and can provide tailored advice to suit your needs.

Managing Debt

Assess Your Debt

Before you can effectively manage your debt, it’s important to assess your current situation and understand the scope of your debt. This includes gathering all the necessary information about your outstanding debts, such as credit card balances, student loans, mortgages, and any other loans or lines of credit.

Create a comprehensive list of your debts, including the outstanding balance, interest rates, and minimum monthly payments. This will give you a clear picture of your overall debt and help you prioritize your repayment strategy.

Prioritize High-Interest Debts

Once you have assessed your debt, it’s important to prioritize your repayment strategy. Start by focusing on high-interest debts, such as credit card balances or payday loans, as these tend to have higher interest rates and can quickly accumulate interest over time.

Make a plan to pay off these high-interest debts first by allocating extra funds towards them each month. Consider implementing a debt avalanche method, where you target the debt with the highest interest rate first and work your way down.

By prioritizing high-interest debts, you can minimize the amount of interest you pay over time and accelerate your journey towards debt freedom.

Negotiate with Creditors

If you are struggling to make your debt payments, it may be worth reaching out to your creditors and exploring options for negotiation. This could involve requesting a lower interest rate, modifying the terms of your repayment plan, or arranging a temporary payment suspension.

Many creditors are willing to work with borrowers who are experiencing financial hardship, especially if it means they are more likely to receive repayment. Be proactive and communicate your situation honestly with your creditors to explore potential solutions.

Consider Debt Consolidation

Debt consolidation is a strategy that involves combining multiple debts into a single loan with a lower interest rate. This can make it easier to manage your debt and potentially reduce your overall interest payments.

There are several options for debt consolidation, such as taking out a personal loan, using a balance transfer credit card, or securing a home equity loan. Each option has its own advantages and considerations, so it’s important to carefully evaluate which one is right for you.

Before pursuing debt consolidation, make sure to compare interest rates, fees, and repayment terms to ensure that you are making a financially sound decision. It’s also important to address the underlying causes of your debt to avoid further accumulation in the future.

Explore Debt Relief Programs

If you find yourself overwhelmed by debt and unable to make your repayments, it may be worth exploring debt relief programs. These programs are designed to help individuals or families struggling with large amounts of debt by providing various forms of assistance.

Debt relief programs can include debt management plans, debt settlement, or even bankruptcy as a last resort. Each program has its own eligibility requirements and implications, so it’s important to seek professional advice before making any decisions.

Working with a reputable credit counseling agency or debt relief organization can help you navigate the complexities of debt management and find the best solution for your specific situation.

Avoid Taking on New Debt

While you are working towards paying off your existing debt, it’s important to avoid taking on new debt whenever possible. This means resisting the temptation to use credit cards for unnecessary purchases or taking out new loans.

Taking on new debt can hinder your progress towards financial freedom and prolong your debt repayment journey. Instead, focus on reducing your expenses, increasing your income, and making conscious spending decisions to avoid accumulating additional debt.

Create a Debt Repayment Plan

To effectively manage your debt, it’s important to create a debt repayment plan. This plan should outline your overall debt goals, your timeline for repayment, and the specific strategies you will use to pay off your debts.

Start by setting realistic and achievable goals, such as paying off a certain amount of debt each month or becoming debt-free by a specific date. Break down your debt into manageable chunks and create a timeline for paying off each individual debt.

Consider using a debt repayment strategy such as the snowball method or the avalanche method. The snowball method involves paying off the smallest debt first and then using the freed-up funds to tackle the next smallest debt, creating a snowball effect. The avalanche method focuses on paying off the debt with the highest interest rate first, ultimately saving you the most money on interest payments.

Select the strategy that aligns with your financial goals, and consistently make payments towards your debts each month to stay on track.

Seek Professional Debt Management Advice

If you feel overwhelmed or unsure about how to effectively manage your debt, it may be worthwhile to seek professional debt management advice. Credit counseling agencies and financial advisors can provide personalized guidance and strategies for tackling your debt.

A credit counseling agency can work with you to create a budget, negotiate with your creditors, and enroll you in a debt management plan if necessary. They can also provide educational resources and tools to help you build strong financial habits and manage your money effectively.

A financial advisor with expertise in debt management can provide tailored advice and strategies based on your specific financial situation and goals. They can help you assess your options, explore potential debt relief solutions, and guide you through the process of achieving debt freedom.

Seeking professional debt management advice can provide you with the knowledge and support you need to make informed decisions and take control of your financial future.

Monitor Your Credit Score

Your credit score is an important indicator of your financial health and can impact your ability to secure loans, obtain favorable interest rates, or even rent an apartment. Monitoring your credit score regularly can help you stay informed about your financial standing and identify any potential issues or errors.

There are several ways to access your credit score for free, such as using credit monitoring services or checking with your credit card provider. It’s important to review your credit report regularly to ensure that all the information is accurate and up to date.

If you notice any discrepancies or errors on your credit report, take immediate action to correct them. This may involve contacting the credit reporting agencies, providing supporting documentation, and following up to ensure that the necessary corrections are made.

By monitoring your credit score and addressing any issues promptly, you can maintain a healthy credit history and improve your financial prospects.

Review Your Credit Reports

In addition to monitoring your credit score, it’s important to review your credit reports periodically. Your credit reports provide detailed information about your credit history, including all your outstanding debts, payment history, and any negative remarks or delinquencies.

Reviewing your credit reports allows you to ensure that all the information is accurate and up to date. It also gives you an opportunity to identify any potential fraud or identity theft.

You are entitled to a free copy of your credit report from each of the three major credit reporting agencies (Equifax, Experian, and TransUnion) once every 12 months. Take advantage of this and request your credit reports to review them thoroughly.

If you spot any errors or discrepancies on your credit reports, contact the credit reporting agencies immediately to dispute the information and have it corrected. This will help ensure that your credit history is accurate and reflects your financial behavior accurately.

By regularly reviewing your credit reports, you can stay informed about your credit standing and take appropriate steps to maintain a positive credit history.

Emergency Fund

Understand the Importance of an Emergency Fund

An emergency fund is a crucial component of financial stability and security. It is a dedicated savings account designed to cover unexpected expenses or emergencies, such as medical bills, car repairs, or job loss.

Having an emergency fund provides a financial safety net and can prevent you from going into debt or depleting other savings when unexpected expenses arise. It can provide peace of mind and buffer against financial stress during challenging times.

Calculate Your Ideal Emergency Fund Amount

The ideal amount for an emergency fund varies depending on individual circumstances, such as income, expenses, and family size. As a general rule of thumb, financial experts recommend saving three to six months’ worth of living expenses in your emergency fund.

To calculate your ideal emergency fund amount, add up all your essential expenses for a month, including rent or mortgage payments, utilities, food, transportation, and insurance. Multiply this amount by three or six, depending on your risk tolerance and circumstances.

Consider any unique factors that may affect your needs, such as dependents, job stability, or health concerns. Adjust your emergency fund target accordingly to ensure that it provides an adequate buffer for your specific situation.

Set Up an Automatic Savings Plan

To ensure that you consistently contribute to your emergency fund, set up an automatic savings plan. This involves scheduling regular transfers from your checking account to your emergency fund savings account.

Automating your savings makes it easier to stay consistent and eliminates the temptation to spend the money on non-essential expenses. Start by determining how much you can afford to save each month and set up a standing transfer or direct deposit to funnel that amount directly into your emergency fund.

Consider treating your emergency fund contributions as a monthly bill or obligation. By prioritizing savings and making it a regular habit, you can steadily build your emergency fund over time.

Explore Different Savings Options

When it comes to saving for your emergency fund, consider different options that offer competitive interest rates and accessibility. Look for savings accounts or money market accounts that offer higher interest rates than regular checking accounts.

Some online banks also offer higher interest rates compared to traditional brick-and-mortar banks. Explore different banking options and compare their rates and terms to find the best fit for your emergency fund.

In addition to savings accounts, consider other low-risk investment options that offer liquidity and relatively stable returns, such as certificates of deposit (CDs) or short-term government bonds. These options typically offer higher interest rates than savings accounts but may have restrictions on accessing the funds.

It’s important to strike a balance between accessibility and potential returns when choosing savings options for your emergency fund. Consider your risk tolerance, liquidity needs, and goals when making a decision.

Reduce Non-Essential Expenses to Contribute to Your Emergency Fund

To build your emergency fund faster, consider reducing your non-essential expenses and redirecting those funds towards savings. This may involve cutting back on dining out, entertainment, or luxury purchases.

Review your monthly expenses and identify areas where you can make adjustments. Look for opportunities to save money without sacrificing your basic needs. For example, you can try meal planning and cooking at home instead of eating out, cancel or downgrade unused subscriptions or memberships, or shop for discounts and deals.

Even small adjustments to your spending habits can add up over time and contribute to your emergency fund growth. Be mindful of your spending choices and prioritize your financial goals.

Utilize Windfalls and Extra Income to Boost Your Emergency Fund

If you receive a windfall, such as a tax refund, bonus, or monetary gift, consider using a portion of it to boost your emergency fund. While it may be tempting to spend the money on non-essential items, prioritize your long-term financial security and allocate a percentage of the windfall towards your emergency fund.

Similarly, if you have extra income from a side gig or freelance work, allocate a portion of it towards your emergency fund. This can accelerate your savings and provide an additional buffer for unexpected expenses.

By utilizing windfalls and extra income wisely, you can make significant progress towards building a robust emergency fund.

Consider Emergency Fund Alternatives

In addition to traditional savings accounts, there are alternative options for building an emergency fund. These options provide liquidity and potential returns while still ensuring that the funds are easily accessible in case of emergency.

One alternative is a high-yield checking account, which offers higher interest rates than regular checking accounts. These accounts often require certain criteria, such as maintaining a minimum balance or setting up direct deposits, but can provide a better return on your emergency fund savings.

Another option is a money market fund, which is a type of mutual fund that invests in short-term, low-risk securities. Money market funds aim to maintain a stable net asset value (NAV) of $1 per share and provide liquidity and relatively stable returns.

Consider these alternatives and assess their benefits, risks, and accessibility before deciding which option is most suitable for your emergency fund.

Income Protection

Review Your Insurance Coverage

One essential aspect of income protection is having adequate insurance coverage. Review your insurance policies, including health insurance, life insurance, disability insurance, and property insurance, to ensure that they meet your needs and provide sufficient coverage.

Health insurance is particularly important as it can protect you from high medical expenses in case of illness or injury. Review your health insurance policy to understand your coverage limits, deductibles, and out-of-pocket expenses. Consider adding supplemental coverage or exploring alternative options if needed.

Life insurance provides financial protection for your loved ones in case of your death. Assess your life insurance needs and consider purchasing a policy if you don’t have one already, especially if you have dependents or financial obligations.

Disability insurance is designed to replace a portion of your income if you become unable to work due to an illness or injury. Understand the terms and conditions of your disability insurance policy and assess whether additional coverage is needed.

Property insurance, such as homeowners insurance or renters insurance, can protect your assets and provide financial compensation in case of damage or loss of property. Review your policy coverage and ensure that it accurately reflects the value of your assets.

By reviewing and adjusting your insurance coverage as needed, you can protect yourself and your income from unforeseen circumstances.

Consider Supplemental Income Protection Policies

In addition to traditional insurance policies, there are supplemental income protection policies that can provide additional coverage in case of unexpected events. These policies are designed to provide financial support and replace lost income during challenging times.

One example is critical illness insurance, which pays a lump sum if you are diagnosed with a specified critical illness. This can help cover medical expenses and provide financial assistance when you are unable to work due to an illness.

Another example is income protection insurance, also known as disability income insurance, which replaces a portion of your income if you are unable to work due to illness or injury. This insurance can help cover your living expenses and provide financial stability during periods of unemployment.

Assess your needs and evaluate the potential benefits of supplemental income protection policies. Consider consulting with an insurance professional to understand the options available and choose the policies that align with your financial goals and risk tolerance.

Explore Unemployment Benefits

Unemployment benefits can provide temporary income replacement if you lose your job or experience a significant reduction in work hours. These benefits are typically provided by the government and can help bridge the financial gap during periods of unemployment.

Research the unemployment benefits available in your country or state and understand the eligibility criteria and application process. Familiarize yourself with the duration and amount of benefits you may be eligible for, as well as any additional requirements, such as job search obligations.

While unemployment benefits may not fully replace your previous income, they can provide a valuable safety net and help cover your basic living expenses during times of unemployment.

Research Government Assistance Programs

In addition to unemployment benefits, there may be other government assistance programs available to support individuals and families in times of financial need. These programs can help alleviate the financial burden and provide temporary assistance until you are able to regain financial stability.

Research government assistance programs in your country or region and understand the eligibility requirements and benefits they offer. These programs can vary widely, from food assistance programs to housing assistance or financial aid for education.

Consult with government agencies or organizations that specialize in providing assistance to understand the options available to you and how to apply for them. Be proactive and take advantage of these programs if you find yourself in a difficult financial situation.

Improve Your Job Security

Job security plays a significant role in income protection. Taking steps to improve your job security can provide a sense of stability and financial peace of mind.

Focus on building a strong professional network and investing in your skills and education. Stay updated on industry trends and emerging technologies to remain competitive in the job market. Seek out professional development opportunities, such as training programs or additional certifications, to enhance your qualifications.

Additionally, cultivate positive relationships with your colleagues and supervisors and demonstrate your value to the organization. Consistently deliver high-quality work, exceed expectations, and seek opportunities for growth and advancement within your current job.

By proactively working to improve your job security, you can reduce the risk of unemployment and increase your earning potential.

Invest in Your Skills and Education

Investing in your skills and education is another effective way to protect your income and increase your earning potential. Assess your current skills and identify areas where you can improve or acquire new skills that are in high demand.

Consider taking online courses, attending workshops or conferences, or pursuing advanced degrees or certifications. These investments in your education can enhance your qualifications and open up new career opportunities.

Continuously learning and adapting to the changing job market can help you remain competitive and position yourself for promotions, salary increases, or even career transitions. By investing in your skills, you can increase your income potential and secure your financial future.

Explore Freelancing or Remote Work Opportunities

In today’s gig economy, freelancing or remote work opportunities can provide additional income streams and increase your financial security. Consider exploring freelancing opportunities in your field of expertise, whether it’s graphic design, writing, coding, or consulting.

Freelancing allows you to diversify your income sources and have more control over your work schedule and projects. It can provide flexibility and the potential to earn additional income during periods of low job security or as a side gig.

Similarly, remote work opportunities offer the flexibility to work from anywhere, which can be particularly beneficial during times of job uncertainty or if you have other commitments that require a flexible schedule.

Explore freelancing platforms, remote job boards, or networking opportunities to find potential freelance or remote work opportunities. Invest time in building your freelance business or developing skills that are in demand in the remote work market.

Diversify Your Income Sources

Relying on a single source of income can be risky, especially in today’s uncertain economy. Diversifying your income sources can provide stability and protect your overall income.

Consider exploring various income-generating opportunities, such as starting a side business, investing in rental properties, or creating passive income streams through dividends or royalties.

Diversifying your income can help mitigate the impact of job loss or economic downturns and provide a more stable financial foundation. It’s important to explore opportunities that align with your skills, interests, and long-term financial goals.

Plan for Potential Income Reductions

Even if you have a stable job and steady income, it’s important to plan for potential income reductions or financial setbacks. Unexpected events, such as economic recessions, industry disruptions, or personal emergencies, can impact your income unexpectedly.

Create a contingency plan that outlines the steps you would take in case of a significant income reduction. This may include reducing expenses, tapping into savings or emergency funds, or exploring alternative income sources temporarily.

By planning for potential income reductions, you can be prepared and minimize the financial stress associated with unexpected changes in your financial situation.

Saving Strategies

Set Specific Saving Goals

Setting specific saving goals is essential for effective saving strategies. Identify your short-term and long-term financial goals and determine the amount of money you need to save to achieve them.

Short-term goals may include saving for a vacation, a down payment on a car, or an emergency fund. Long-term goals may include saving for a down payment on a house, retirement, or your children’s education.

Be as specific as possible when setting your saving goals. Determine the timeline for achieving each goal and break down the total amount into manageable monthly or yearly savings targets.

Setting specific saving goals provides clarity and motivation, making it easier to stay committed to your saving strategies.