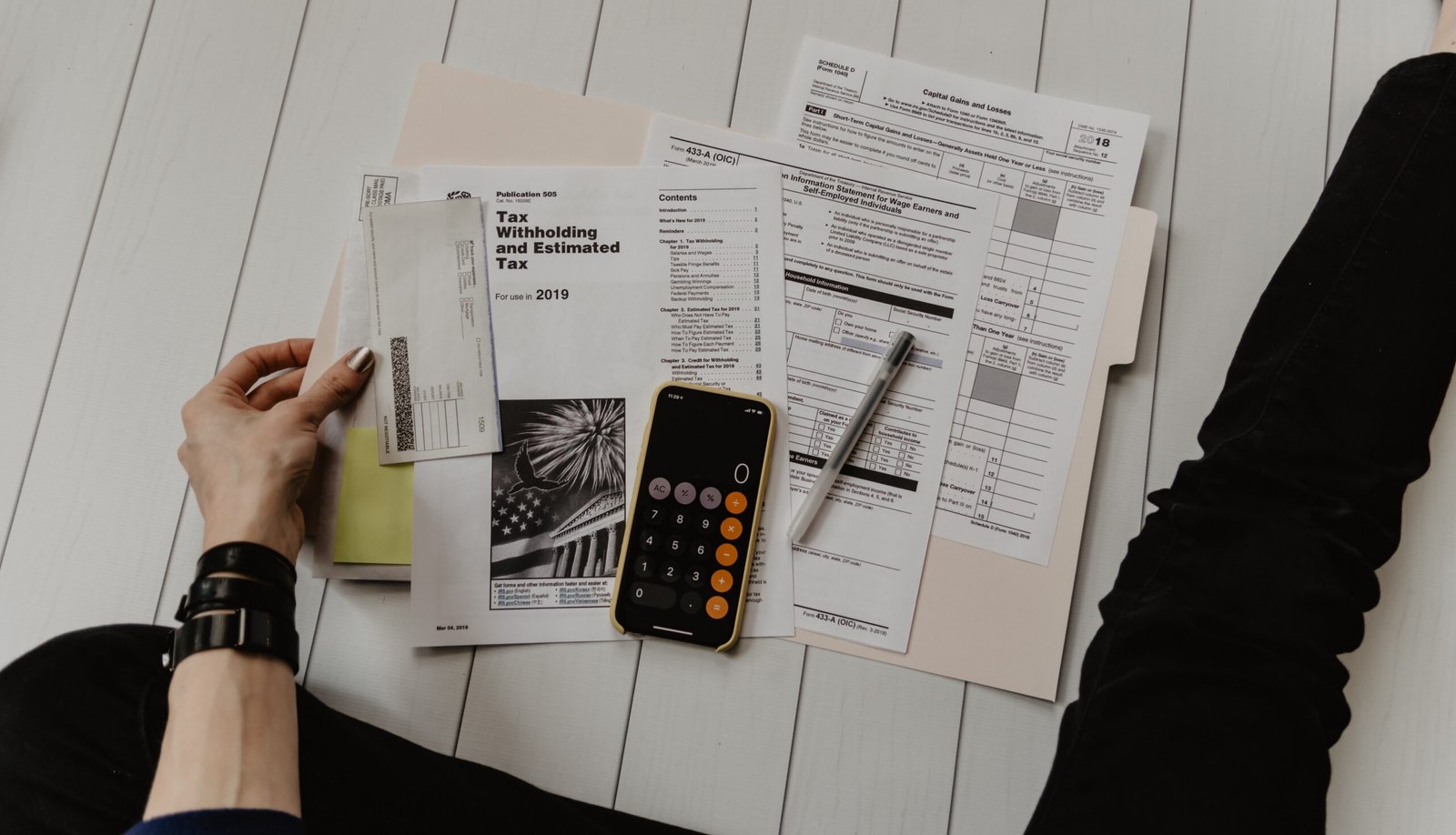

“How Money Works” is an insightful article that explores the intricate mechanics behind the world of finances. Delving into the fundamental principles that govern our monetary system, the article provides a comprehensive overview of how money functions in today’s society. From the concepts of currency and inflation to the complex workings of banks and investments, this article sheds light on the essential knowledge needed to navigate the intricate web of finance. By unraveling the mysteries of money, readers can gain a deeper understanding of its role in our lives and make more informed financial decisions.

Check Other Money Aesthetic Aricles

What is Money?

Definition of Money

Money is a medium of exchange that allows individuals and businesses to facilitate transactions and trade. It typically takes the form of a currency, such as coins or banknotes, and is accepted as a legal tender within a country or region. Money serves as a universal tool for buying goods and services, paying debts, and measuring the value of assets. In essence, money is a fundamental component of modern economies, enabling economic activities to take place efficiently and effectively.

Functions of Money

Money serves several essential functions in an economy:

-

Medium of Exchange: Money acts as a common medium that facilitates the exchange of goods and services. It eliminates the need for bartering goods directly, allowing individuals to easily trade goods for money and then use that money to purchase other goods or services.

-

Unit of Account: Money serves as a standard unit of measurement for determining the value of goods and services. It provides a common benchmark for comparing prices and expressing economic values.

-

Store of Value: Money allows individuals to store and preserve their wealth over time. Rather than holding physical goods as a store of value, money can be saved or invested, providing a means for wealth accumulation and future use.

-

Standard of Deferred Payment: Money serves as a mechanism to settle debts, loans, and financial obligations over time. It provides a consistent and universally accepted method of payment for transactions that occur in the present but may be paid in the future.

Types of Money

There are various forms of money, each with its own characteristics and level of acceptance. The main types of money are:

-

Commodity Money: This type of money has intrinsic value as a commodity. Examples include gold, silver, and other precious metals that were historically used as currency.

-

Fiat Money: Fiat money is legal tender that is backed by the government or central bank. Its value is derived from the trust and confidence placed in the issuing authority. Most modern currencies, such as the US dollar or the Euro, are fiat currencies.

-

Representative Money: Representative money is backed by a commodity such as gold or silver. However, the physical commodity is not used directly as money. Instead, paper notes or certificates that can be exchanged for the underlying commodity represent the value.

-

Digital or Electronic Money: With the rise of technology, digital or electronic money has become increasingly prevalent. It refers to money that exists only in digital form, such as bank deposits, electronic transfers, and online payment systems.

-

Cryptocurrencies: Cryptocurrencies such as Bitcoin or Ethereum are virtual currencies that use cryptography for security and operate independently of any central authority. They rely on decentralized technology, known as blockchain, to verify transactions and maintain a transparent and secure system of money management.

-

Virtual Currencies: Virtual currencies are digital representations of value that are typically used within specific online communities or games. They function as a medium of exchange within those environments but may have limited acceptance outside of them.

History of Money

Barter System

Before the invention of money, individuals relied on a barter system to conduct trade and exchange goods. In a barter system, goods or services are directly exchanged for other goods or services without the need for a medium of exchange. Although this system allowed for basic trade, it had several limitations, such as the lack of a standardized measure of value and the requirement for a coincidence of wants between trading parties.

Early Forms of Currency

As societies evolved, people began using various objects as mediums of exchange. These early forms of currency included shells, beads, animal hides, and even agricultural products. These objects held value within specific communities and were widely accepted in trade.

Introduction of Coins and Paper Money

The use of coins as a form of currency can be traced back to ancient civilizations, such as the Greeks and the Romans. Coins were made from precious metals, like gold or silver, and had a standardized weight and design. They provided a portable and durable means of carrying and exchanging value.

The introduction of paper money, or banknotes, originated in China during the Tang Dynasty in the 7th century. These early banknotes represented a claim on a certain amount of gold or silver held by the issuing entity, such as a local bank or merchant. Over time, paper money became widely adopted as a more convenient and practical alternative to carrying large quantities of precious metals.

Check Other Money Aesthetic Aricles

Characteristics of Money

Durability

Money needs to be able to withstand the wear and tear associated with daily use. It should be made from materials that do not easily deteriorate, ensuring that its value and functionality are preserved over time. In modern times, paper currencies are continually improved to enhance durability and longevity.

Portability

Money should be easily portable so that individuals can carry and exchange it conveniently. The physical form of money, whether in the form of coins or banknotes, should have a relatively small size and weight compared to the value it represents. This characteristic allows money to be easily transported and used in various transactions.

Divisibility

Divisibility refers to the ability to divide money into smaller units of value. Money should be easily divisible so that it can be used to make transactions of different magnitudes. For example, a dollar can be broken down into coins or smaller denominations, allowing individuals to make purchases at different price points.

Uniformity

Uniformity ensures that money is readily recognizable and standardized across a particular currency. For effective use in trade, money should have consistent designs, sizes, and features that make it easily identifiable as legitimate currency. This characteristic helps to prevent counterfeiting and ensures trust in the currency’s authenticity.

Limited Supply

To maintain its value and prevent inflation, money must possess a limited supply. Central banks and monetary authorities manage the supply of money in an economy to maintain price stability and control the overall level of economic activity. By regulating the supply, money retains its value and functions as an effective medium of exchange.

Acceptability

Money must be universally accepted within a particular economy for it to serve its purpose. Individuals and businesses should have confidence that the money they receive will be accepted by others as a medium of exchange. This broad acceptance allows money to circulate, facilitating economic transactions across a wide range of participants.

Central Banks

Definition of Central Bank

A central bank is a financial institution that acts as the primary authority responsible for managing a country’s money supply, monetary policy, and financial stability. It operates independently from the government and aims to maintain price stability, promote economic growth, and ensure the stability of the financial system.

Role of Central Banks

Central banks play a crucial role in the economy by implementing monetary policy, regulating commercial banks, and serving as lenders of last resort. Some key functions of central banks include:

-

Monetary Policy: Central banks formulate and implement monetary policies to control inflation, manage interest rates, and stabilize the overall economy. By adjusting interest rates and controlling the money supply, central banks can influence borrowing costs, consumer spending, investment levels, and overall economic activity.

-

Reserve Requirements: Central banks establish and enforce reserve requirements for commercial banks. These requirements mandate that a certain percentage of customer deposits must be held in reserve, reducing the risk of bank failures and ensuring that sufficient liquidity is available in the banking system.

-

Interest Rates: Central banks have the power to set interest rates, which influence borrowing costs for individuals, businesses, and financial institutions. By adjusting these rates, central banks can stimulate or restrict economic growth and control inflationary pressures.

Check Other Money Aesthetic Aricles

Money Creation

Fractional Reserve Banking

In a fractional reserve banking system, commercial banks are only required to hold a fraction of their customers’ deposits as reserves. The remaining portion is available for lending and investment purposes. This practice allows banks to create money through lending, as the loaned funds are recorded as both a liability (deposits) and an asset (loans) on the banks’ balance sheets.

Deposit Creation

When a customer deposits money into a bank, the bank can lend a portion of that deposited amount to other borrowers. This process of lending creates additional deposits, effectively increasing the money supply in the economy. This expansion of the money supply through lending is known as deposit creation.

Multiplier Effect

The multiplier effect refers to the expansion of the money supply that occurs as a result of the banking system’s ability to create new loans and deposits. When banks lend money, the created deposits circulate within the economy and can be redeposited by the recipients into other banks. This cycle continues, leading to further loan creation and money supply expansion.

Money Supply

The money supply refers to the total amount of money in circulation within an economy. It includes both physical currencies, such as coins and banknotes, as well as various forms of bank deposits. Central banks closely monitor and control the money supply through various mechanisms, such as open market operations, adjustments to reserve requirements, and changes in interest rates.

Types of Money

Commodity Money

Commodity money is a form of currency that has intrinsic value and is directly exchangeable for a physical commodity. Examples of commodity money include gold, silver, or other precious metals. Historically, commodity money was widely used, as the value of the currency was determined by the value of the underlying commodity.

Fiat Money

Fiat money is the most common form of money in modern economies. It is backed by the government and has value because the government declares it as legal tender. Fiat money does not have any intrinsic value and cannot be exchanged for a physical commodity. Instead, its value is based on the trust and confidence placed in the issuing authority and the belief that others will accept it as a medium of exchange.

Representative Money

Representative money is a type of currency that is backed by a physical commodity, such as gold or silver, but is not directly exchangeable for the commodity itself. Instead, paper notes or certificates represent the value of the underlying commodity and can be exchanged for it upon demand. Representative money combines the convenience of using paper currency with the assurance that its value is backed by a tangible asset.

Digital or Electronic Money

Digital or electronic money refers to money that exists only in electronic form, typically held in bank accounts or digital payment platforms. Digital money allows for instant electronic transactions, making it convenient for online purchases or electronic transfers. It has become increasingly prevalent in modern societies, providing a convenient and efficient means of conducting financial transactions.

Cryptocurrencies

Cryptocurrencies are virtual or digital currencies that use cryptography for security and operate on decentralized technology known as blockchain. Unlike traditional forms of money, cryptocurrencies are not issued or controlled by any central authority, such as a government or central bank. They rely on encryption techniques to secure transactions, maintain transparency, and enable peer-to-peer transfers.

Virtual Currencies

Virtual currencies are digital representations of value that are often used within specific online communities or gaming platforms. They typically operate as a medium of exchange within these environments, allowing users to purchase virtual goods or services. However, their acceptance and use outside of these communities are limited.

Functions of Money

Medium of Exchange

One of the primary functions of money is to serve as a medium of exchange. Money enables individuals to easily trade goods and services without the need for direct bartering. By acting as an intermediary, money eliminates the need for a double coincidence of wants, allowing for more efficient and convenient transactions.

Unit of Account

Money serves as a unit of account by providing a standardized measure of value for goods and services. By assigning prices to various products and assets, money enables individuals and businesses to compare and evaluate their worth. This common unit of measurement aids in economic decision-making and facilitates economic planning.

Store of Value

Money allows individuals to store their wealth and preserve purchasing power over time. Unlike perishable goods, which may lose value or deteriorate, money can be saved or invested, serving as a store of value. By holding money, individuals can delay consumption and retain the ability to purchase goods or services in the future.

Standard of Deferred Payment

Money serves as a standard of deferred payment, allowing individuals and businesses to settle debts or financial obligations over time. By providing a universally accepted medium of payment, money enables the exchange of goods and services in the present with the promise of payment in the future. This function is essential for economic activities such as lending, borrowing, and issuing credit.

Inflation and Deflation

Definition and Causes of Inflation

Inflation refers to the sustained increase in the general price level of goods and services over time. It erodes the purchasing power of money, meaning that a given amount of money can buy fewer goods and services. Inflation can be caused by various factors, such as an increase in the money supply, rising production costs, or excessive demand.

Effects of Inflation

Inflation can have significant economic effects. It can reduce the real value of savings and fixed-income assets, erode consumer purchasing power, and generate uncertainty about future prices. High inflation can also distort economic decision-making, as individuals and businesses may prioritize short-term spending to avoid further losses in purchasing power.

Measuring Inflation

Inflation is typically measured using various economic indicators, such as the Consumer Price Index (CPI) or the Producer Price Index (PPI). These indices track the changes in prices of a basket of goods and services over time. By comparing the current price levels to a base period, inflation rates can be calculated, providing insights into the pace of price increases.

Deflation and its Implications

Deflation refers to a sustained decrease in the general price level, resulting in an increase in the purchasing power of money. While deflation may seem beneficial initially, it can have adverse effects on the economy. Deflation can lead to reduced consumer spending, as individuals may delay purchases in anticipation of lower prices. This decline in demand can weaken economic growth and potentially lead to unemployment and economic instability.

Currency Exchange

Foreign Exchange Market

The foreign exchange market, also known as the forex market, is where currencies are bought and sold. It is a decentralized global market that facilitates the exchange of one currency for another. The forex market operates 24 hours a day, allowing individuals, businesses, and financial institutions to trade currencies and hedge against foreign exchange risks.

Factors Affecting Currency Exchange Rates

Several factors influence currency exchange rates, including:

-

Interest Rates: Higher interest rates in a country can attract foreign investors, increasing the demand for its currency and potentially strengthening its exchange rate.

-

Inflation Rates: Lower inflation rates in a country can increase its competitiveness by maintaining price stability. This can attract foreign investments and strengthen the exchange rate.

-

Economic Performance: Strong economic fundamentals, such as higher GDP growth, lower unemployment rates, and stable fiscal policies, can positively impact a country’s currency and lead to a stronger exchange rate.

-

Political Stability: Political stability and favorable government policies can enhance the attractiveness of a country as an investment destination. This, in turn, can strengthen its currency’s exchange rate.

Fixed vs. Floating Exchange Rates

Exchange rate systems can be classified into two main categories: fixed and floating exchange rates.

-

Fixed Exchange Rates: Under a fixed exchange rate system, the value of a country’s currency is fixed or pegged to a specific foreign currency, such as the US dollar or the Euro. Central banks intervene in the foreign exchange market to maintain the exchange rate within a narrow band.

-

Floating Exchange Rates: In a floating exchange rate system, the value of a currency is determined by market forces, such as supply and demand. The exchange rate fluctuates freely based on market conditions, without central bank intervention. Most major currencies operate under a floating exchange rate system.

Currency Speculation

Currency speculation involves taking positions in the foreign exchange market with the goal of profiting from anticipated changes in currency exchange rates. Speculators attempt to exploit fluctuations in exchange rates by buying a currency when they expect it to appreciate and selling it when they anticipate depreciation. Currency speculation can have both benefits and risks, as it can provide liquidity to the market but also contribute to increased volatility.

Financial Institutions

Commercial Banks

Commercial banks play a vital role in the financial system by providing various financial services, such as accepting deposits, granting loans, and facilitating payments. They serve as intermediaries between savers and borrowers, mobilizing funds from individuals and businesses and directing them towards productive investments. Commercial banks also provide a range of financial products, including checking and savings accounts, credit cards, mortgages, and business loans.

Investment Banks

Investment banks primarily focus on providing financial services to corporations, institutions, and governments. They assist in raising capital through underwriting securities, facilitating mergers and acquisitions, and offering advisory services. Investment banks also engage in trading activities, such as buying and selling stocks, bonds, and other financial instruments. Unlike commercial banks, investment banks do not have retail banking operations and typically cater to a more specialized client base.

Credit Unions

Credit unions are financial cooperatives owned and operated by their members. They provide banking services, such as savings accounts, loans, and mortgages, but with a specific focus on serving the needs of their member-owners. Credit unions often offer competitive rates and lower fees compared to traditional banks, as their primary objective is to benefit their members rather than maximize profits.

Insurance Companies

Insurance companies provide coverage and protection against various risks, including property damage, liability, health, life, and other unexpected events. They collect premiums from policyholders and use these funds to cover potential losses. Insurance companies help individuals and businesses manage and mitigate risks by providing financial compensation in the event of covered losses. They play a vital role in safeguarding individuals and promoting economic stability.

In conclusion, money is a fundamental element of modern economies, serving as a medium of exchange, unit of account, store of value, and standard of deferred payment. It has evolved throughout history, transitioning from barter systems to various forms of currency, such as coins, paper money, and digital money. Central banks play a crucial role in managing the money supply, implementing monetary policies, and ensuring financial stability. Moreover, money creation occurs through fractional reserve banking and the lending activities of commercial banks, resulting in an expansion of the money supply. Understanding the characteristics, types, and functions of money, as well as concepts like inflation, currency exchange, and financial institutions, is essential for comprehending the complexities of the modern financial system.